Overview

Loan stacking is a huge issue for financial institutions in sub-Saharan Africa. Technology that can quickly spot this behavior and alert financial institutions (FIs) in near real-time is vital to the informed decision making processes needed to operate a lending business in today’s financial services ecosystem.

Pngme aggregates, structures, and labels traditional and non-traditional financial data and in doing so, helps fintechs and banks detect and prevent high risk behaviors like loan stacking. We want to provide some insight into this specific issue based on West African data and how we, as a technology company, offer the tools to address this industry-wide problem.

Our technology and tools are trusted by some of sub-Saharan Africa’s leading fintechs and banks who are working to negate the effects of loan stacking and zero-in on credit invisible and invisible prime customers in their respective markets.

Defining Loan Stacking

While loan stacking can be defined in many ways, for the purposes of this article, we define it as a user who takes out a loan with another lender in order to pay back a loan with an existing lender. Measuring this behavior in quantitative terms can be challenging, so in order to simplify the analysis, we’ve set a further time definition of a user applying for a loan within three days of receiving a late payment notification.

Traditionally, tracking this behavior has been acutely challenging for banks and FIs. The data they depend on is captured weeks if not months apart, making it impossible to see financial actions within a shorter time frame. The data itself has historically been fragmented and has not necessarily provided an accurate picture of an individual’s finances.

“Historically, there’s been a lot of confusion around what’s actually included in scoring models.[…] Using [credit bureaus’] data, lenders hope to minimise risk by only putting money into the hands of ‘trustworthy’ customers.”

FIs are also limited by their inability to pull data from multiple accounts simultaneously. A view of data across multiple accounts would provide a substantially more comprehensive customer financial profile.

In Nigeria, having multiple accounts and small loans from multiple lenders is a common behavior and in and of itself does not signal loan stacking or a poor credit rating. In fact, these users can actually be strong candidates for credit, having established a good history across lenders. However, the current system lacks reliable resources for lenders to distinguish loan stacking from simply having multiple accounts at the pace and scale needed for FIs to remain competitive.

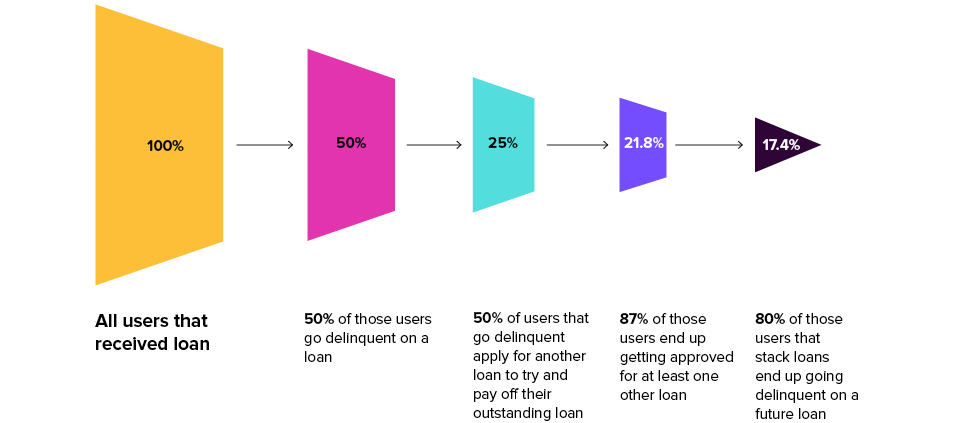

The above data illustrates the scale of the problem in Nigeria and is based on FIs offering small loans to both individuals and MSMEs. The pivotal point being the re-application stage, meaning, once you have data on an initial loan delinquency, the first reapplication is a strong indicator of potential loan stacking behaviors and signals the need to alert or closely monitor financial behavior in the short-term.

Making Identifying Loan Stacking Simple

Pngme detects loan delinquencies via late payment reminder messages in a user’s logs. We can then effectively identify loan stacking for FIs thanks to the speed and frequency at which we read USSD data and serve it as actionable insights to our customers. From there, customers can build alerts and automation that best serve their business needs.

2020-09-27 8:08am Overdue notice

Dear <Name>, this is a notice that your loan repayment of 9.774,88 NGN is now overdue. Kindly effect payment immediately. Contact us if you need further assistance.

2020-09-28 7:20am Reapplication following overdue notice

Your loan of NGN 12000.0 has been approved and sent to your bank account. Your repayment of NGN 15204.0 is due by 12/10/2020.

Let’s look at how the speed of data processing propels our ability to identify loan stacking. Thanks to Pngme’s innovative SDK and API, FIs can start ingesting data at the very moment a user applies for a loan, and then that data is updated twice daily. Traditional Credit Bureaus can, at their fastest, report a user has gone delinquent on an outstanding loan after a day, but more often lenders may take up to a month to report delinquencies or may not report them until the loan defaults months later.

It’s this lag in data ingestion and reporting which stops FIs from creating a detailed picture of customer behavior like the one below. Insights are served into Pngme’s Customer Management Platform with regular automated alerts.

“Digital technologies brought on by Fintechs, APIs, mobility, AI, big data analytics and more enables traditional lenders to deliver hyper-relevant lending experiences with optimized data-driven insights. Consumers benefit from online originations, quicker decision-making and processing and often no paper.”

We can see that there is a large spike of applications within just one hour of receiving a late notice. 40% apply within 24 hours. This illustrates how users are applying for loans before the lender has had time to notify the bureau of their delinquency.

Pngme offers its partners the ability to set alerts for this type of behavior based on their level of risk threshold. The amount of time between loans or amount owed are variable factors an FI can adjust for their risk threshold. Over time, an FI can build an accurate model of percentage likelihood of defaulting on loans based on their customers’ historic and real-time data.

The second advantage Pngme has is its ability to read and process non-traditional data in conjunction with traditional financial data. With the ability to read SMS data/transactions every 12 hours, Pngme can gain critical insights post-loan disbursement and understand a user’s cashflow beyond their initial loan.

Coupling the SMS data with the capacity to link multiple bank or mobile money accounts gives FIs the ability to trigger alerts as well as segment customers who display loan stacking behavior. After all, having multiple active accounts doesn’t necessarily signal a high risk borrower or loan stacking behavior. Users with multiple accounts can often be dependable borrowers. All of these disparate data points are housed in a Customer Management Platform that non-technical users can easily navigate. By implementing Pngme’s technology stack, you can automate lending with confidence in sub-Saharan African markets.

Why Work with Pngme

Identifying loan stackers is one of the many issues facing FIs that Pngme’s technology solves for. Learn more about how our SDK, API, and Customer Management Platform are revolutionizing data and finance in sub-Saharan Africa.

We provide the only real-time traditional and non-traditional alternative data for lending behavior in sub-Saharan Africa.

We have 90+% data coverage in Nigeria, Kenya, and Ghana.

We have business leaders in every geography, including engineering and account teams from companies like Branch, MTN, Microsoft, and Uber.

Pngme is data compliant and adheres to data privacy regulations in Nigeria, Kenya and Ghana.

We have a simple pricing structure customizable to meet your needs and goals.