Fintech solutions are now successfully enabling Small and Medium Enterprises (SMEs) to optimize alternative data and scale credit decisioning through machine-learning.

However, MFBs often face difficulty in expanding their individual consumer portfolios. The primary reason for this is the divide between the financial history the consumer is able to provide and the products financial institutions are able to offer based on the provided data.

The consumer is limited in only being able to share traditional, often outdated, financial information collected by credit bureaus.

MFBs are limited to only creating financial products that suit the traditional data that comes from credit bureaus.

An MFB can only build a credit product as dynamic as the data it is receiving and processing. With decades of only having traditional data to hand, which is often limited and incomplete and excludes sms, the credit products available fall short of what they could offer with better data. This has resulted in:

Consumers dropping off during the application process

Often, an applicant will abandon their application due to not being able to provide the financial information necessary for their application to be reviewed.

Consumer applications being rejected

To no fault of their own, the information an applicant is able to provide may not suit the products the MFB is offering, and without more information or products that are able to meet the applicant’s current financial profile, the application is declined.

Poor underwriting data

The data provided by the applicant and the traditional data sources on which the MFB is relying doesn’t provide the necessary complete picture of the applicant.

Speed of decision making

Difficult for banks to vet new customers due to time needed to review the data

Banks and MFBs have long been losing out on significant potential revenue thanks to this long-standing disconnect between the financial products available and the financial products would-be customers can actually use.

Consumers with healthy revenue and spending habits have been locked out of traditional financial products, leaving them invisible to banks and leaving banks cut off from entire segments of potential new customers.

Now that financial data can be accessed and utilized in more ways than ever before, all in real time, banks and MFBs can finally tap into the undeniable, huge business potential of connecting with new customer segments.

Pngme data can drive opportunities to expand consumer portfolios where data is traditionally sparse. Not only can Pngme’s non-traditional data complete the snapshot of an applicant’s financial health, it can also power new and innovative credit products for a financial institution to make available to these new customers. Here is a look at the kind of new customer connecting with MFBs in each region:

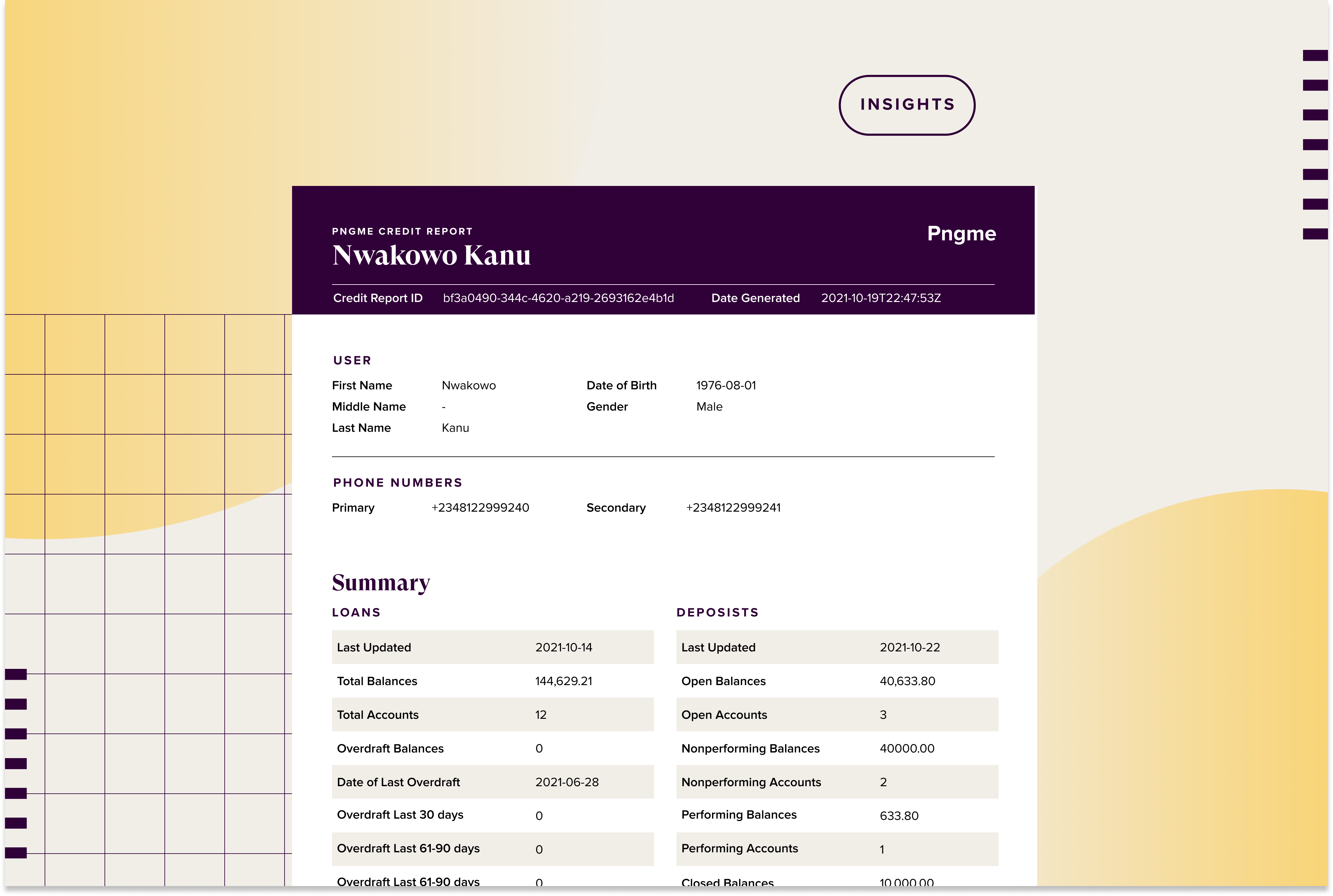

Example of a Hidden Customer Pngme can Access

Nwakowo Kanu lives and works in the town of Kuje just outside of the city of Abuja in Nigeria. Nwakowo has multiple bank accounts due to the connectivity issues in Kuje, carrying a small positive balance in each account. He is a small business owner and on a monthly basis, deposits his earnings across his accounts.

Despite Nwakowo’s regular income and savings among his accounts, a traditional credit report would not pre-qualify him for a loan because it would not be able to see the aggregate savings across accounts and take into consideration non-traditional transactions like SMS. This, coupled with the data being at least 30 days old, makes him a risky borrower in the eyes of most banks. Nwakowo fits the profile of over 70% of Nigerians who can’t access basic finance.

Download full credit report HERE

Age: 43

Geo Location: Kuje, Nigeria

Connected Bank Accounts: 8

Connected Fintech Accounts: 2

Insurance: None

Homeowner: Yes

For more information on Pngme’s alternative credit scoring capabilities:

Sign up for Developer access HERE