Blog

- PerspectivesProtecting Your Lending Business From FraudWhile new technology has certainly paved the way for new scams, it has also given us new, robust tools for safeguarding against fraud and minimizing impact if it occurs. By finding a reliable data partner, lenders can safeguard against fraud in a few key ways.Read more2 years ago

- PerspectivesDe-risking your Lending Business During an Economic RecessionThe tools and technologies banks and fintechs in Africa should adopt during uncertain economic times.Read more2 years ago

- Product AnnouncementMeet Pngme's Feature Librarycalculate debt-to-income ratio, view a user's cash flow, and more. We make creating insights easy.Read more2 years ago

- Case StudyHow Fintechs are gaining a competitive edge with PngmePngme provides real-time comprehensive financial profiles de-risking lending decisioning within days of integratingRead more2 years ago

- Pngme Dashboard 3.0Welcome to The New Pngme DashboardEverything you need in one place to explore data, manage your account and start accessing financial dataRead more2 years ago

- How toHow to Query Pngme's API in 4 MinutesLearn how to access Pngme's API and access data in 4 minutesRead more2 years ago

- InsightsConnecting with New Customer SegmentsHow increasing financial data access and data labeling provides access to new customer segments.Read more2 years ago

- PerspectivesMake An Impact: Engineering the Future with CTO Nick MassonWe sat down with Nick for a quick chat about what excites him about leading Pngme’s engineering teams.Read more2 years ago

- InsightsPngme Insight 3: On-Device Financial HistoryPngme provides actionable insights through its mobile SDK and unified API. Such insights are driving growth and powering robust credit capabilities with the top banks in the market.Read more2 years ago

- AnnouncementWe Raised $15M in Series A Funding to Power the Future of Financial Services in Africa!We are excited to announce that we have raised a further $15 million in Series A funding as we set out to grow our financial data infrastructure and machine learning-as-a-service platform.Read more3 years ago

- InsightsTraditional vs Real-Time Credit ModelsTraditional credit scoring methods rely on narrow, often outdated sets of data and are in desperate need of improvement. The traditional data that banks and FIs depend on to score customers excludes the unbanked population of 3+ billion people across the globe, and forfeits an incredible opportunity for growth.Read more3 years ago

- InsightsHow Your Customer Data Can Build Alternative Credit ModelsInformation derived from non-traditional data sources reveals dynamic and meaningful insights that can be used in assessing risk and ultimately improving loan approval rates.Read more3 years ago

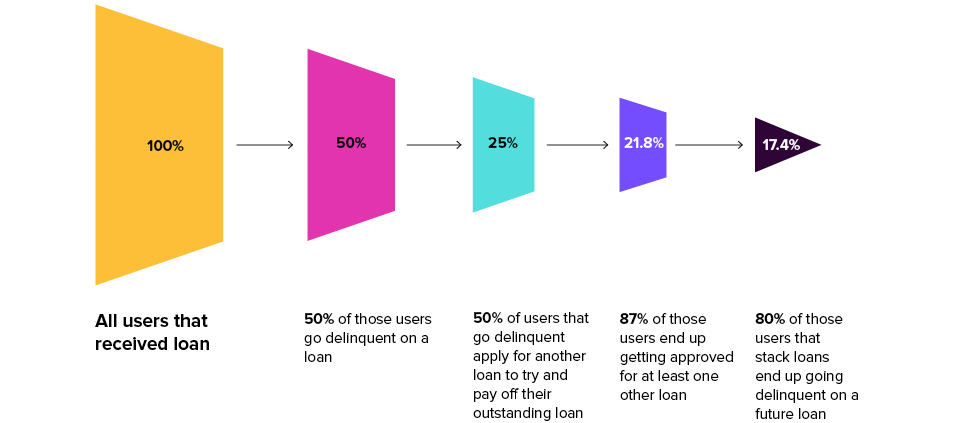

- InsightsHow Pngme Helps Financial Institutions Identify Loan StackingLoan stacking is a huge issue for financial institutions in sub-Saharan Africa. Technology that can quickly spot this behavior and alert financial institutions (FIs) in near real-time is vital to the informed decision making processes needed to operate a lending business in today’s financial services ecosystem.Read more3 years ago

- PerspectivesWhat Is Self-Sovereign Data And Why Does It Matter In The Time of COVIDCovid-19 is changing the financial landscape of Africa. Since the outbreak of the pandemic, banks and financial institutions have seen a pivot from cash-centric systems to digital ecosystems.Read more3 years ago

- Podcast400 Million People In Sub-Saharan Africa Without Formal Credit FilesPngme’s Founder and CEO, Brendan Playford appeared on the Tearsheet podcast to speak with Zack Miller, Editor-in-Chief about Pngme’s plans in 2021.The 20min interview provides a focused snapshot of our vision for financial inclusion and how Pngme and companies like it, are providing the infrastructure and services for thin-file, credit invisible individuals in Africa and beyond.Read more3 years ago

- InsightsThe Future of Open Banking in Nigeria: Predictions from Pngme’s Lagos TeamPngme is experiencing rapid growth in the region spearheaded by two experienced technologists and in-market experts.Read more4 years ago